Plunging 40%! Who really made money on the Red Sea incident?

Since mid-December last year, the global maritime supply chain has been disrupted by Houthi attacks on ships in the Red Sea.

On the Asia-Europe route, the collective rerouting of several shipping lines around the Cape of Good Hope at the southern tip of Africa has triggered a "butterfly effect" that has swept through the shipping industry.

Revenues from the Suez Canal fell sharply in the first ten days of January 2024 as shipping lines suspended Red Sea/Suez Canal sailings.

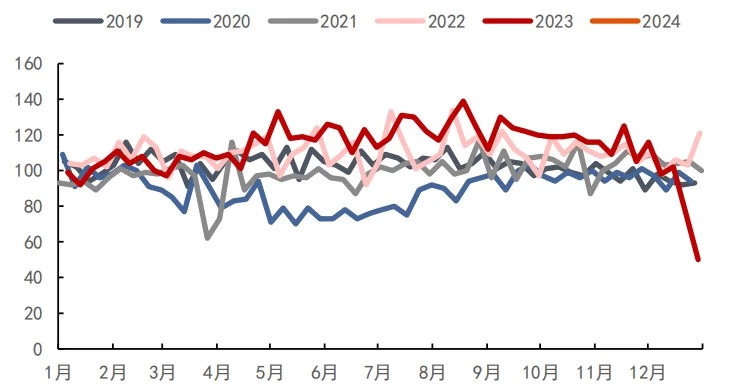

According to Alphabliner, 544 ships passed through the Suez Canal between January 1 and January 11 this year, a 30% drop compared to 777 ships in the same period last year.

Suez Canal container ship traffic

Suez Canal tolls are an important source of foreign exchange for Egypt. The decrease in the number of ships in transit has led to a 40% drop in canal revenues compared to the same period last year.

This figure was confirmed by Egypt's Suez Canal Authority.

On January 25, local time, Ossama Rabie, the Suez Canal Authority, issued a statement saying that the Suez Canal's revenues could fall to $6 billion, or 40%, if tensions in the Red Sea persist.

In terms of freight rates, the soaring freight rates on the Asia-Europe route, brought about by ship detours, have been eased recently.

According to SCFI Containerized Freight Index, the tariff from Far East to Europe was US$2,861 per TEU (20-foot container), down US$169 or 5.6% from the previous week.

Far East to Mediterranean Sea freight rate per TEU is 3,903 U.S. dollars, compared with the previous week fell 164 U.S. dollars, down 4.0%.

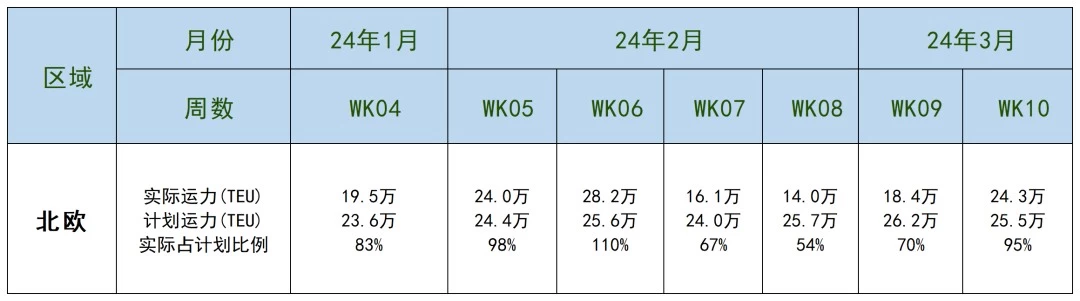

The butterfly effect triggered by the ship detour is expected to gradually appear in the 7th, 8th and 9th weeks of 2024 on the supply side of capacity.

It is understood that the Red Sea incident triggered by the container ship bypass in mid-December - early January increased significantly, the ship bypassed the Far East to Europe, a round-trip voyage from the previous 70 days to 90 days or so.

According to the relevant data, the actual capacity in Week 7, Week 8 and Week 9 of 2024 is expected to be 67%, 54% and 70% of the planned capacity. The low level of actual capacity will support spot market rates.

Sunny Worldwide Logistics We has already signed contracts with three major international shipping companies and have FOB, CIF and DDP service to worldwide via sea and air with 26 years. Welcome to try an order.