Panic! This year's sea freight rates may blow through the roof!

Any relief that the ports of Los Angeles and Long Beach may receive due to stalled imports during the Chinese New Year period will be offset by labor shortages at terminals and local warehouses caused by the outbreak of the new coronavirus variant Omicron, port leaders have warned.

Employers of Southern California marine terminals and more than 1.8 billion square feet of factories and warehouses struggle every day to find enough labor.

In an interview with JOC, Pacific Maritime Association (PMA) president Jim McKenna said more than 1,800 dockworkers on the West Coast tested positive for Covid-19 in the first three weeks of January, exceeding the 1,624 confirmed cases in all of 2021.

There is a huge impact on the labor availability of dockers, especially skilled dockers driving container moving equipment in the yard.

In addition, JMintzmyer (a well-known shipping analyst), founder and chief analyst of Value Investor`sEdge, warned in the latest interview that the strike crisis at the US West Terminals is at risk of rising"blow through the roof".

According to reports, Mintzmyer said in an exclusive interview with Fringe Finance that the big problem facing the supply chain this year is that the International Warehousing and Dockers Union (ILWU), which represents the West American dockworker, is about to renew the contract that expires at the end of June.

The contract was rolled over for three years in mid-2019, when industry market conditions were far weaker than they are now. Labor now has enormous bargaining power and may seek more favorable terms.

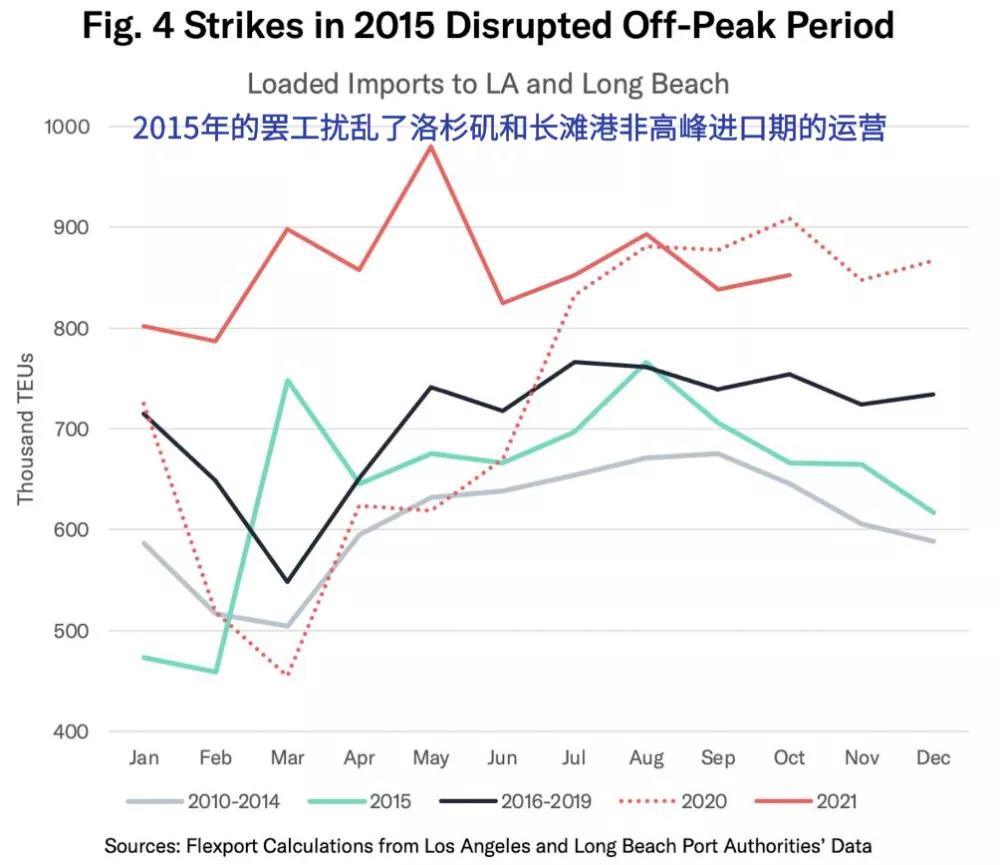

The last round of negotiations, in 2014-15, did not go well and disrupted terminal operations. Backlogs in the first quarter of 2015 were similar to levels in early 2021, according to Flexpot.

International Longshore and Warehouse Union (ILWU) in November 2021 rejected an offer by its employer, the Pacific Maritime Association, PMA, to extend the labour contract for a year, which could set the stage for intense negotiations between the two sides this year, which will also give ports the disruption. The current congestion at the ports of Los Angeles and Long Beach make similar port disruptions in 2022 take longer to recover.

Mintzmyer warned that if there is no consensus between labor and management, leading to worker strikes or port closures, the congestion could worsen, sending ocean freight rates skyrocketing.

Mintzmyer said that while the U.S. Infrastructure Act does allocate a lot of money for port construction, these oversized construction bills take years to process. He believes that the benefits will not be realized until 2023-2024.

He also pointed to the global policy response to the coronavirus (COVID-19) as an important factor in disrupting supply chains.

He said that at the end of 2019, the industry market situation was quite tight, and the US ports (especially the West Coast) faced the dilemma of underinvestment for 10 years, and the large-scale blockade disrupted the overall operation of the port.

Mintzmyer said the easing of restrictions has worked, but supply chains are largely disrupted, and even the most optimistic scenario will take months to ease.

It will take at least 8 months to resolve the reliability of the shipping schedule

According to an assessment by maritime data and consultancy Sea intelligence, it will take eight to nine months for container liners to return to schedule reliability amid the Covid-19 pandemic and supply chain disruptions.

The agency uses the 2015 U.S. West Coast as a comparable benchmark for assessing the industry's prospects.

"Since the 2015 issue (Western US port labor negotiations) was resolved within 6-7 months, this translates to an average reduction of 1.25-1.46 days of delay per month," Sea intelligence said. "If the current port and hinterland system can recover at the same pace, that means the current delays will take 8-9 months to resolve."

In December 2021, the on-time rate of ships from Asia to the US West Coast was only 10.1%, compared to 12.6% in February 2015. Meanwhile, the consultancy estimates that ships will arrive an average of 11.5 days late in December 2021 compared to the pre-pandemic baseline, compared with 8.7 days in February 2015.

Sea intelligence assessed that if the recovery starts in December 2021, when the latest data was collected, in this case, the container industry will return to normal in August or September this year.

In reality, however, it will take a while, as there was no sign of an improvement in carrier schedule reliability as of February.

Meanwhile, the 2015 problems only affected the West Coast of the United States. "But now it's a global challenge, and the problem also includes inland logistics," said sea intelligence.